Sommaire du n°16 :

In Botswana, Mma Ramotswe is helping her adopted son, Puso, with his homework:

Mma Ramotswe: ‘It says that if it takes one man one hour to dig the ditch, then how long would it take for three men to dig the same ditch? What do you think is the answer to that, Puso?’

Puso frowned. ‘It would be very hard for three men to dig one ditch, Mma. They would always be getting in each other’s way. So it would probably take longer than it would take one man to do it. Maybe two hours?’

Mma Ramotswe smiled. ‘We don’t have to worry about practical things when we’re doing sums,’ she said.

Alexander McCall Smith, The Limpopo Academy of Private Detection

Understanding the nature of cooperation and its ability to deliver better outcomes is a valid pursuit for economists, administrators, as well as Botswanan school boys. Does cooperation make things better or worse? Does it provide transformative increases in productivity, like Adam Smith’s pin factory, or does it become a confused tangle of men digging a ditch more slowly?

This paper seeks to understand whether cooperation – specifically the codevelopment of new military equipment by international partners – is financially ‘efficient’; in other words, whether it represents a good way for defence administrations to spend their money to procure military equipment. As the title of the paper suggests, the paper challenges the dominant narrative found in the defence economics literature that cooperation is ‘inefficient’. What ‘inefficient’ actually means and how it is correctly evaluated is discussed. The paper furthermore argues that cooperation, even when assessed in purely financial terms, represents a good policy choice. However, like Puso’s homework, we need to know what sums we are doing and whether ‘practical things’ can sensibly be excluded from consideration.

Scope

This paper has a deliberately narrow scope, excluding many areas of potential interest to readers. Its scope is limited to consideration of the level of cost avoidanceThe term cost avoidance is preferred to ‘savings’. Within public administrations ‘savings’ could imply the freeing up of budgets for potential redistribution. Cost avoidance may or may not generate savings. observed within international co-development projects. In limiting the scope in this way, it excludes consideration of other cooperative activities and project phases outside of co-development. It also excludes non-financial benefits of co-development, whether as a motivation for cooperation or a side-benefit. It also excludes consideration of causal factors for any observed degree of financial efficiency. It does this in order to make its central argument effectively. The rationale for this is as follows:

Cooperation tends to be focused in the aerospace domain where development costs dominate over production costsThe literature is also focused on cooperation within a Euro-pean and NATO context. The paper does not attempt to go outside of that context. . Academic interest, as reflected by the literature, appears to follow the money in focusing most analysis on this cooperative phase.

Clearly there are benefits of cooperation that are not financial (see Hartley, 2006 for examples). Nations enter into a cooperative arrangement for a variety and mix of motivations. It is the author’s view, however, that financial performance is critical to the credibility of cooperation in the eyes of policy makers. It is therefore important to isolate this aspect of cooperative performance as far as possible. Although this may require an artificially narrow view which has limitations (which are reached in the paper) it is necessary in order to counter the narrow assertion of ‘inefficiency’ by defence economists.

Finally, the causes of financial efficiency/inefficiency, though fascinating, cannot be treated adequately in a short paper. Moreover, the author believes such considerations can distract from or distort consideration of the central question of financial performance. A long discussion, for example, of juste retour and the ability of global balance to alleviate it, can leave the reader focused on interesting but insignificant cooperative shortcomings, while missing the more pedestrian but financially overwhelming gains of sharing development costs between nations.

Before entering into a consideration of the economic literature and the author’s analysis, it is worth considering what is meant by the terms (in)efficiency or (in)efficient. Rather than offer a definition, a number of nuances are noted in the use of these terms:

1. Efficient/inefficient can be used in a quantitative sense (e.g., ‘internal combustion engines are typically 35% efficient’) or a categorical sense (e.g., ‘means tested distribution of minor is inefficient and should be stopped’).

2. Quantitative measurement of efficiency must be done against a standard. This can either be against a perfect ideal (e.g., internal combustion can be tested against perfect combustion done in a lab) or some accepted, real-world norm (e.g., ‘private companies can distribute unemployment benefits more efficiently than government departments’).

3. Rather than define efficiency within a narrow technical perspective (e.g., ‘ratio of useful work done verses energy consumed’), efficiency can be defined in terms of the optimal allocation of resources towards a desired outcome such that any reallocation of resources will produce a less good outcome.

With those nuances in mind, we can proceed to consideration of the defence literature.

The Inefficiency Narrative Overview of Cooperation in the Defence Literature

Cooperation sits within a spectrum of acquisition options available to nations ranging from national development and production at one extreme through to military off-the-shelf (MOTS) at the other. Cooperation itself can exist in many forms. Lorell (1980, p.2) identifies three main forms of cooperation: licensed production, reciprocal purchase and collaborative international development. It is the latter which is the focus of this work, being the dominant form of cooperation and the one where efficiency is most debated. Here again, there is a spectrum of views, ranging from contrarian writers, such as Kincaid, who suggests European defence cooperation has been “spectacularly unsuccessful” (Kincaid, 1999) through to institutions such as the European Defence Agency (EDA), which considers enabling defence cooperation its raison d’être (EDA, 2017).

Cooperative acquisition is intended to benefit partners through the effects of specialisation, standardisation and scale (Matthews, 1992, p.149). All contribute to cost avoidance, but the literature consistently highlights different factors that erode the level of benefit achieved (see Heuninckx, 2008). These include technical and administrative issues which increase transaction costs between partners, along with issues of mistrust or imperfect mutual knowledge, which limit what can be achieved below some theoretical ideal (White, 2005). Various solutions are offered to alleviate their negative impact and, to that extent, the literature can be generally characterised as more functionalist (solution oriented) than theoretical, though theories are occasionally evoked. As discussed in the scope section, this paper does not attempt to analyse these factors.

It is worth noting in passing that international co-development tends to be limited to major projects, principally because they are not affordable by nations on their own. They are not ‘typical’ acquisition projects being expensive, complex and risky undertakings even when undertaken on a national basis. They also tend to be concentrated in the aerospace sector where development costs are high compared to unit production costs (see Hartley, 2019 and Pugh, 2007).

Theoretical positions

The defence cooperation literature is usually not explicit on theoretical perspectives adopted. Hartley (2012) draws on Public Choice theory as an explanatory framework for causes of inefficiency, linked to the persistent theme of cooperation as a deviation from perfect markets. Hartley asserts that “[e]conomics is the dominant explanation” of cooperation (Hartley, 2019, p.242) but is not often explicit about which aspects of economic theory are applied to the evaluation of efficiency. Hartley also explores the economic theory of clubsPresumably drawing on Buchanan (1965) though he is not cited. as an explanatory mechanism (Hartley, 2012). Public Choice theory is explicitly cynical of actors’ motivations, with Hartley talking of “vote seeking politicians, budget maximising bureaucrats and rent-seeking industries” (2019, p.244). DeVore (2011) similarly draws on Principal-Agent and Collective Action theories to argue that “shortcomings [are] intrinsic to the collaborative process” (ibid., p.661).

Other treatments, such as the thoroughgoing analysis by Faure (2015), provide much richer explicit theoretical treatment of cooperation but do not touch on the question of efficiency. Where the literature does address efficiency, some form of cost-benefit analysis is normally assumed (e.g. Matthews, 1992, p.149).

The literature is sometimes characterised by combative and emotive language when discussing cooperation. Hartley suggests that thinking on collaboration is “dominated by myths, emotion and special pleading” which need to be “exposed and subjected to critical evaluation” (2019, p.235). DeVore similarly argues against ‘scholars and policy makers’ (2011, p.625) however, like Hartley, he does not actually identify or cite any of the proponents of cooperation. It is therefore difficult to position their arguments accurately, since the positions they are criticising cannot be assessed. There is a risk that they are deploying strawman arguments against imaginary foes.

It should be noted that more heterodox economic perspectives and theories are emerging (e.g. see Mazzucato, 2018). These, however, have not, to the author’s knowledge, penetrated into defence economics, although more sociologically and psychologically informed positions are tackling defence more broadly (Faure, 2015; Pannier, 2016).

Empirical data used in Literature

There is widespread recognition in the defence literature of the paucity of empirical data in defence acquisition, due in large part to the sensitivity of the data, but exacerbated in the case of cooperation by the scarcity of cooperative projects. Matthews (1992) suggests that “Attempting to unearth cost and related data for comparative evaluation would be a heroic exercise” and suggests that “ … [t]his empirical inability to provide substantive evidence of cost savings had led to suspicions that collaboration may involve cost premiums” (Matthews, 1992, p.150). The UK National Audit Office report (NAO, 2001) was one of the most significant set of empirical data presented. Hartley, writing in 2019 was able to identify around thirteen11 identified but one of these was Complex Weapons which had at least 4 major cooperative projects. major cooperative armament projects initiated between 1958 to 2001, a 43 year period (Hartley, 2019 Table 11.3). The dataset has grown over time so that, for instance, DeVore could develop comparisons over four generations of European combat aircraft cooperations (DeVore, 2013).

Handling of counterfactuals

A simple definition of efficiency might be the ratio of benefit derived compared to the investment made. For an engine, this is relatively straightforward to measure. However, the complex nature of defence acquisition makes efficiency difficult to measure. Consideration tends to be reduced to a relative measure, either comparing the ratio of benefits for a fixed investment or the ratio of investment for a fixed benefit. Financial efficiency (cost avoidance) uses the latter, but it is critically dependent on the accuracy of the (counterfactual) predicted investment level for a national approach.

The UK’s National Audit Office (NAO) sought to do this by comparing the costs of cooperative projects against comparator national projects (NAO, 2001, p.16, Table 11). It calculated the global (cooperative) development cost as a percentage of the counterfactual project cost with values ranging from 141-143% for two partners, 161-179% for three partners and 196% for the four partner Typhoon. The NAO did, however, recognise that “there is no way of establishing the reliability of cost estimates of options that were not adopted” (NAO, 2001 para 2.5).

Hartley and Braddon (2014, p.4) defined an idealised, “perfect case” cooperation case as being a “single procurement agency and a single prime contractor with its suppliers selected on commercial criteria” with the anticipated result that partners would only pay 1/N of the equivalent national project cost, where N is the number of international partners (ibid., p.6, footnote 3). Hartley (2019, Table 11.4) reiterates this definition of ‘perfect’ cooperation efficiency and notes that “… actual European arms collaborations depart from the perfect model of economically efficient collaboration.” (ibid., p.244). It is worth noting, in passing, that he associates cooperative costs (i.e. those things that reduce performance below the ideal) with the central involvement of national governments in “resource allocation choices” (Hartley & Braddon, 2014, p.4) indicating an assumption that markets are efficient and governments are not.

Economic Evaluation of Cooperative Performance

The NAO (2001), while presenting empirical evidence that shows clear net cost avoidance through cooperation (see above), entitles the section: “The Department has estimated that the overall costs of cooperative development programmes may be up to twice as high as for national alternatives” (para 2.7). When addressing cooperative production, it states that “[e]fficiency has often been compromised by a rigid adherence to the principal [sic] of juste retour” (para 2.9).

DeVore (2011) similarly presents a negative picture of cooperative efficiency by comparing performance to an unattainable objective e.g. “weapons projects rarely, if ever, produced all of these potential benefits” (ibid., p.629, emphasis added) before stating that “In sum, no project profited from more than a small portion of the benefits theoretically offered by collaboration.” (Ibid., p.661). He reinforces this with a recommendation to states to “reassess their conviction that improved international institutions will render armaments collaboration efficient at some future date”, believing that there are “shortcomings intrinsic to the collaborative process” and that “[f]or most categories of weaponry, states will find other defense-industrial policies superior to collaboration” (Ibid. p.661). Anticipating the analysis section, it should be noted that dismissing approaches because they do not achieve all of their intended benefits would invalidate all approaches because projects achieving all their intended outcomes is extremely rare (Hastie & Wojewoda, 2015).

Hartley (2019) is more measured in his assessment, recognising that “national [i.e. non-cooperative] projects are rarely perfect and efficient” (ibid., p.245), nevertheless he lapses into the dominant negative narrative: “the evidence provides only limited support for the hypothesis that collaboration is always superior to national projects” (ibid., p.253). Similarly, after analysing European Defence cooperation he states that “For the UK, the major lesson from European collaboration is that they [sic] remain inefficient with considerable opportunities for efficiency improvements”. Elsewhere, Hartley (2012, p.45) claims that “Collaboration is usually inefficient which raises questions as to why governments continue with inefficient programmes” (p.4, para 5).

The overall picture offered in the defence economic literature is at best one of faint praise, at worst one of both a negative diagnosis and a negative prognosis: claiming it is not only in-efficient, but it is also irredeemably inefficient.

Analysis

Calculating the efficiency of a co-development project

Before offering a critique of the defence economic literature, it is worth looking at the problems with calculating any efficiency or cost-avoidance value for a cooperative co-development.

In simple terms, the cost to each nation of co-developing a military product with other international partners should be compared to the cost of developing the identical product nationally. The ratio of the two figures will give a quantitative measure of financial efficiency, the difference will give the level cost avoidance.

Reality is more complex. The codeveloped product will tend to deviate from each nation’s preferred product, either because of the need to compromise on requirements or, conversely, the accumulation of features to match differing national requirements. This is a potential cause of ‘inefficiency’ and therefore beyond the scope of this paper, but it is worth noting as a complicating factor for any quantitative calculation. Any such calculation is rendered more difficult by the need to separate out the inevitable mix of cooperative and national elements within any cooperative contract. For example, PAAMS was a cooperative programme, but cooperation did not include the radars; Empar was used by France and Italy, Sampson by the UK. There is also the issue of sunk costs prior to entering into cooperation. For example, the UK and France made significant investments into key technologies prior to the cooperative development of the Scalp EG/Storm Shadow missile.

Hartley and Braddon (2014) represents a thoroughgoing attempt to test how the financial efficiency of a co-development varies with the number of partners, drawing on multiple military and one commercial example. In their conclusions they note that: “Various factors determine the performance of collaborative projects and there are major data problems in ‘holding constant all relevant factors’; there are a variety of performance indicators; and the benefits of collaboration and their valuations differ between nations; nor are accurate cost data available” (p.13).

Due to this unavoidable uncertainty, the paper does not bring forward an empirical argument to demonstrate cooperation’s ‘efficiency’. Rather, it offers a critique based on the evidence and arguments used by defence economists who suggest that cooperation is inefficient.

Framing Errors

One of the more insidious aspects of the literature is the introduction of framing errors when talking about the costs of cooperative projects. For instance, the NAO suggests that: “… in terms of their total cost, cooperative development [projects] are usually more expensive overall than national ones” (NAO, 2001, p. 16 Para 2.7). They also provide details of five cases where they were able to “… carry out analysis, all of which show that the cooperative option was estimated to be at least a third more expensive in global terms than the national alternative” (ibid., para 2.5).

One has to ask the question, ‘more expensive to whom?’. It is clearly not more expensive to each of the each of nations participating in the co-development, each of whom pays less than a national development would cost. Nor is it more expensive ‘in global terms’ than the global cost of all the nations doing separate development projects.

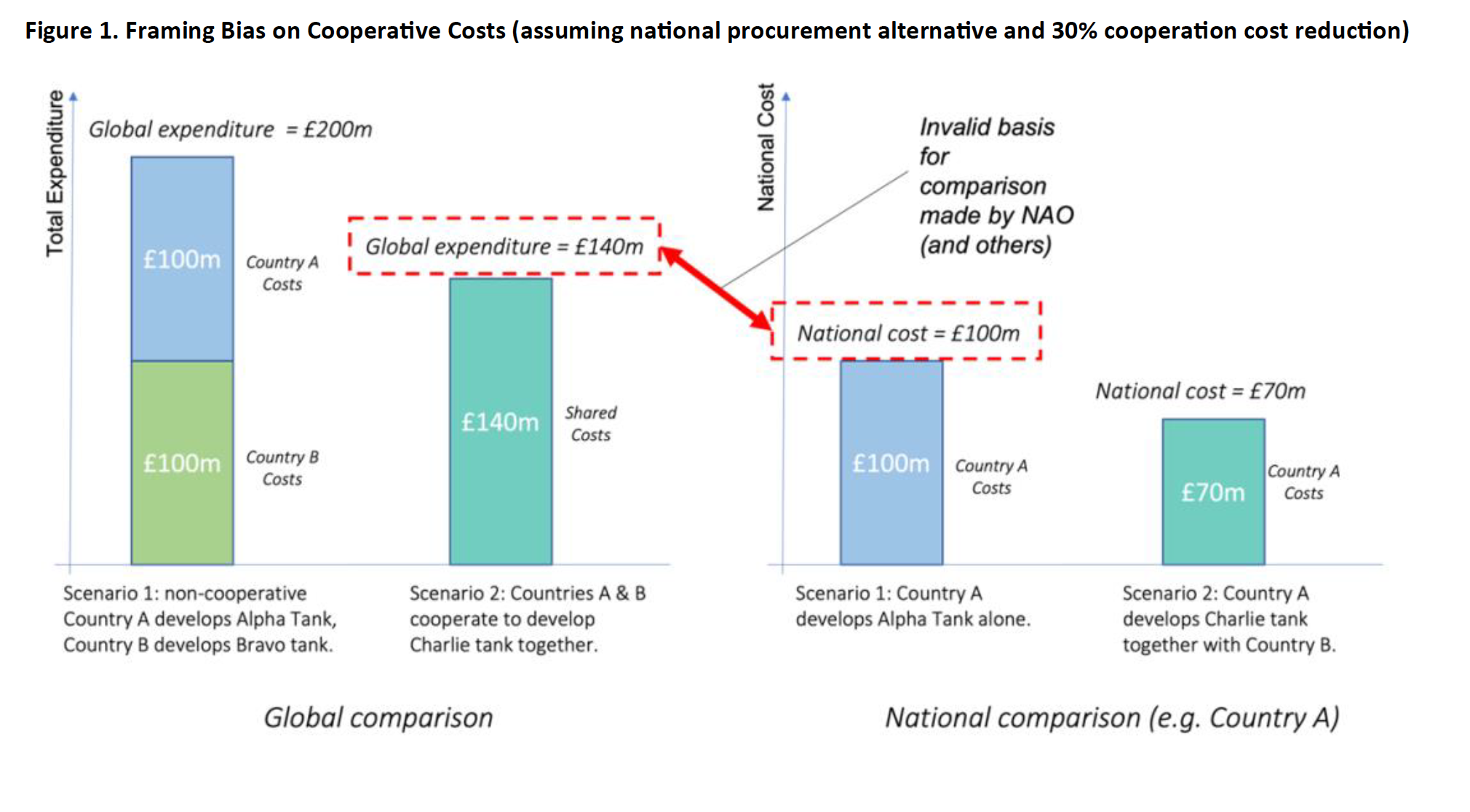

This is a simple framing error, where the cost of a single national development project is compared to the cost of a cooperative development project. This is illustrated in Figure 1 to make the comparison clear. It assumes that cost avoidance of around 30% is achievable through cooperation (consistent with NAO empirical estimates, see below). The total expenditure on the co-development is higher than the expenditure by a single nation on a single development however, that is a meaningless comparison. The cost to the nation in the example shown drops from £100m to £70m. The global cost drops from £200m to £140m. From either perspective, national or global, cooperation leads to a less costly outcome.

It is important to make the comparison explicit. Failing to do so creates a situation where something that will cost each participating nation less is described as ‘more costly’ – effectively calling black, white.

The case of multilateral projects such as A400M is more complex: smaller nations would be more likely to purchase MOTS if cooperation was not an option, so any global comparison is more complex. However, the main issue here is again the use of loose language that gives a misleading impression that cooperation is somehow more costly.

Figure 1. Framing Bias on Cooperative Costs (assuming national procurement alternative and 30% cooperation cost reduction)

Baselines for evaluation: breaking even, idealism and heuristics

The literature regularly refers to a heuristic which estimates the cost of a co-development project relative to that of an equivalent project undertaken nationally, suggesting this follows a function, where N is the number of partners involved. The earliest reference the author can find for this is in Delpech (1976). This estimates the anticipated level of cost avoidance for the partners as around 30% for a bilateral project, 42% for a trilateral project, 50% for a quadrilateral project etc5. An alternative equation is mentioned in Lorell (1980, p.5) which suggests lower levels of cost avoidance where N < 3 but values around 20% higher where N > 3. This latter formula has not been adopted more widely. There is no record of empirical evidence, nor any theory used to derive either formula, although there is an underlying logic to the heuristic discussed below.

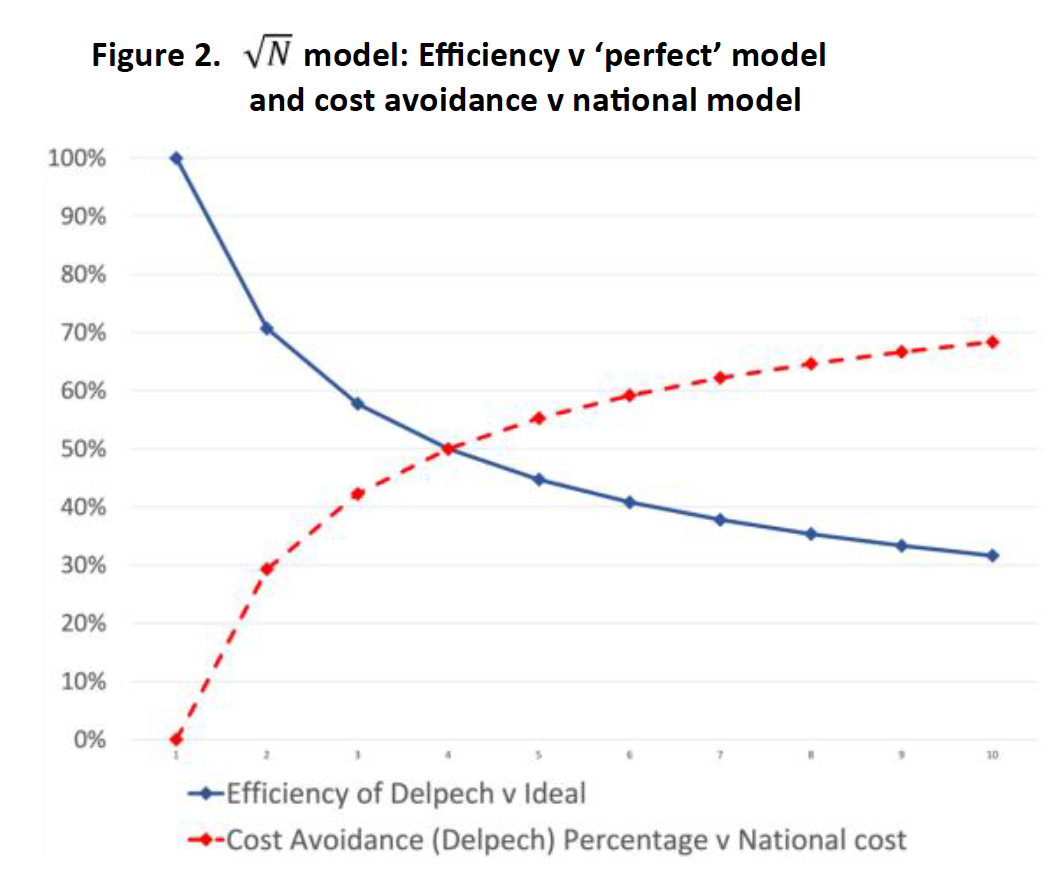

Braddon and Hartley identify what they call the ‘perfect case scenario’ (2014, p.6, footnote 3) where there would be zero additional cooperative cost per nation as the basis for their assessment of efficiency. In practice this would mean the cost of the co-development project would be divided by N, where N is the number of partners. This is made explicit in Hartley (2019, p.243, Table 11.4) where the total R&D costs would ideally be 25% for each partner in a four nation cooperative development. Whilst in a certain way this appears perfectly logical, it is a highly problematic construction. It gives rise to the perverse situation shown in Figure 2 where, if the heuristic is assumed, the “efficiency” decreases with the addition of more partners, while the level of cost avoidance for each partner increases. In essence, the adoption of the ‘perfect case’ as a baseline against which to assess efficiency, leads to a nonsense: the more cost nations avoid, the more ‘inefficient’ cooperation is deemed to be. This leads to the inexorable conclusion that the optimum level of cooperation is no cooperation at all. This can helpfully be labelled as a ‘perfectionism fallacy’.

The opposite approach to this ‘perfect case’ model would be to assume that any cooperation that reduces the net cost to a nation below the cost of a national project is deemed efficient. This ‘break-even’ criterion could be argued to set the bar too low. This is where the heuristic can be helpful.

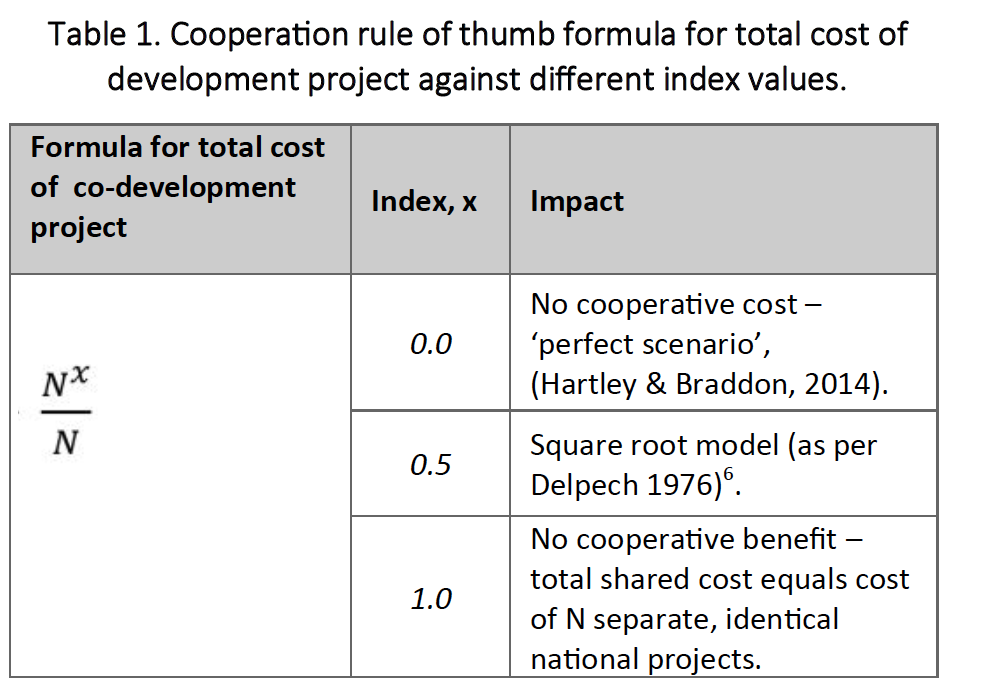

It is worth looking at three ‘models’ together. If we define a term ‘Cooperative Cost Avoidance Factor, or CCAF, as the percentage of cost avoided by a nation cooperating on a co-development, this can be calculated as follows: where the index, x, is zero for the ‘perfect case’, 0.5 for the Delpech model and 1 for the ‘just break even’ model. The model sits at the geometric mid-point between ‘perfect’ cooperation and the minimal ‘break even’ point. See Table1.

There is a strong argument that the model is a good baseline to measure the efficiency of any cooperation, the ‘par’ performance expected. Its widespread use in cost estimating by governments and industries indicates a degree of realism though, using it as a common baseline to measure cost-avoidance performance would be a new step. A bilateral cooperation that achieved a CCAF of 20%, rather than 30% would be below the anticipated baseline performance. Conversely, where circumstances were favourable, such as where the industrial body delivering the co-development was a single commercial entity that spanned the two nations, a higher CCAF might be expected.

This provides a relatively clear and simple approach for fore-casting, or at least measuring, the financial performance of any cooperative co-development. However, there is a further problem.

Unequal Cooperative Partnerships

In the use of the model, there is an implicit assumption that partners invest equally. However, except in bilateral cooperative projects this is not generally the case. Partner shares in Typhoon, Meteor and A400M projects, which involve 4, 6 and 7 partners respectively, are all different. This creates two difficulties: firstly, in estimating the total cost of the co-development (since it is no longer times the equivalent national development) and secondly in calculating the CCAF seen from the perspective of the different nations.

Figure 2. model: Efficiency v ‘perfect’ model and cost avoidance v national model

Table 1. Cooperation rule of thumb formula for total cost of development project against different index values.

There is a strong argument that the model is a good baseline to measure the efficiency of any cooperation, the ‘par’ performance expected. Its widespread use in cost estimating by governments and industries indicates a degree of realism though, using it as a common baseline to measure cost-avoidance performance would be a new step. A bilateral cooperation that achieved a CCAF of 20%, rather than 30% would be below the anticipated baseline performance. Conversely, where circumstances were favourable, such as where the industrial body delivering the co-development was a single commercial entity that spanned the two nations, a higher CCAF might be expected.

This provides a relatively clear and simple approach for fore-casting, or at least measuring, the financial performance of any cooperative co-development. However, there is a further problem.

Unequal Cooperative Partnerships

In the use of the model, there is an implicit assumption that partners invest equally. However, except in bilateral cooperative projects this is not generally the case. Partner shares in Typhoon, Meteor and A400M projects, which involve 4, 6 and 7 partners respectively, are all different. This creates two difficulties: firstly, in estimating the total cost of the co-development (since it is no longer times the equivalent national development) and secondly in calculating the CCAF seen from the perspective of the different nations.

In the first instance, the NAO (2001, p.16, Table 11) estimated the total cost of the joint Typhoon project to be equivalent to 196% of the estimated cost of a national project. This is very close to the derived estimate of 200%

However, the investment shares of the nations are not 25% each but 37.5%, 30%, 19.5% and 13% for the UK, Germany, Italy and Spain, respectively. Intuitively, as one or more nations’ investment share moves up from an equal, 25% share, we would expect the total shared project cost to reduce since, in extremis, it is tending towards a one nation project. A co-development divided into (highly theoretical) 97%, 1%, 1% & 1% shares would cost much closer to the total cost of a national co-development (100%) than the 200% predicted. It is possible to develop an adjusted cooperative efficiency estimate using the actual partner investment levels and this is being attempted. In the case of Typhoon, assuming a simple linear relationship between share and CCAF, the estimate for the cooperatively efficient baseline would reduce the figure estimated to be nearer 150% than 200%This is the subject of a future paper. The figure provided is a broad, provisional estimate as the mathematical model is still being developed. .

On the second difficulty, that of calculating a CCAF for each nation, a calculation is straightforward however, it is not clear how meaningful this is. In the literature, DeVore appears to incorporate the UK’s investment share into his calculation of efficiency (2013, p.438, Table III)A total cost of 196% of the presumed national cost, the net equivalent cost for the UK is 37.5% (UK share) x 196% = 73.5% - a net saving of 26.5%. . This gives a CCAF of 26.5% for the UK, a figure he describes as ‘modest’. His conclusions focus on efficiency seen from the perspective of the ‘largest participants’ (ibid.) where it could be argued to be meaningful (assuming, of course, that that is what the major investors are seeking). He fails, unsurprisingly, given his preferred narrative, to discuss the efficiency seen by the smaller participants. In the case of Spain, with its 13% share in the project, the CCAF achieved was 74.5%This presumably could be described as ‘immodest’. .

This degree of disparity in levels of CCAF experienced by different partners calls the meaningfulness of such calculations into question. Were financial efficiency the only motivation, there would be a rush by nations to reduce their cooperative share to boost their ‘efficiency’. In reality, national constraints and non-financial benefits from cooperation act as motivations but consideration of these are outside the self-imposed constraints of this paper.

Proportionality

One further issue with the defence economic literature, DeVore in particular, is the lack of a sense of proportion. He argues that “… the British NAO estimates the aircraft’s development costs to have exceeded those of an equivalent national project by 96%. As a result, the Eurofighter’s largest contributors economized only 26.5% on development costs by collaborating rather than building aircraft on a national basis” (DeVore, 2013, p.237, emphasis added). Leaving aside the framing error, he manages to imply a greater than 25% reduction in cost as a failure on what is a multibillion-pound development programme. He appears to have no comprehension of what that means in practice in the context of permanently stretched defence budgets. Despite much useful historical analysis DeVore, both here and in other papers, appears to have no sense of the practical realities of the field he pronounces so emphatically upon.

Cooperation sits as one of many imperfect options available to government officials. Greater financial economies could potentially be made through competition – not a point DeVore makes – but here, as with unequal partnerships – the reason competition is not blindly pursued lies outside the self-imposed limits of this paper. Issues of national and military autonomy, wider economic benefit and other factors can preclude competition. There is an increasing body of evidence on the downsides of competition. As Taylor suggests “there is a line of reasoning and body of evidence that fair competitions can be either not feasible, or not desirable, or both.” (Taylor, 2016, p.32).

Use of Language

Finally, putting quantitative arguments to one side, there are also semantic problems in the defence literature. The use of words is at the heart of this issue, specifically the words “efficient” and “efficiency”. This is best exemplified by Hartley’s statement that “Collaboration is usually inefficient which raises questions as to why governments continue with inefficient [projects].” (Hartley, 2012, p.4). This statement appears to shift from a quantitative view of efficiency (‘usually inefficient’ implying a figure below perfection) to a categorical one (inherently not the best solution, so why do governments continue with it?). Conflating the two meanings leads to the false corollary that any shortfall against an unreachable ‘perfect scenario’ means the approach should be abandoned.

A more appropriate definition of efficiency can help avoid such errors. A definition in a form where efficiency relates to the optimal use of resources is less easily distorted since it deals with comparison of real-world choices, rather than abstract idealsThere are various suggested definitions along these lines – e.g. “…efficiency implies [a] state in which every resource is optimally allocated to serve each … entity in the best way” (Investopedia Team, 2020) . It is also more aligned to the perspective of policy and decision makers, requiring a comparison of all available, workable approaches, rather than assessing individual approaches against an imagined ideal.

There have been attempts to capture the ‘good but not perfect’ nature of financial benefits of cooperation with Hartley’s use of ‘cost effectiveness’ (2019, p.250) and one author using the rather paradoxical title of ‘Beneficial Inefficiency’ (Woodward, 2018). Neither of these appears sufficiently explicit or technically unambiguous so the author has used the term “Cooperative Cost Avoidance Factor” (CCAF). It clarifies the positive nature of what is achieved and focuses explicitly on financial efficiency.

Summary of Analysis

The analysis has identified a number of flaws with the assertion found in the defence economic literature that cooperation is inefficient. All credible analysis, including that by cooperation’s detractors, indicates that cooperation provides significant cost avoidance. Use of the term cooperative cost-avoidance factor, or something similar, would avoid some of the loose terminology, obvious framing errors and the ambiguity between the quantitative and categorical uses of the word ‘inefficient’. The heuristic appears to provide a credible baseline for assessing cooperative performance – both theoretically and practically – avoiding both the perfectionism fallacy and a complacent ‘break even’ objective.

The scope of consideration has been deliberately narrow, focusing only on financial benefits, and this approach reaches its limitations when considering unequal, multi-national partnerships or competition as alternative approaches. In these instances, wider considerations have to come into play and Puso’s ‘practical things’ have to intrude on this neat analysis as well as that of the defence economists.

Recommendations

Firstly, administrators and policy makers should recognise that international co-development will generate considerable cost avoidance for nations. As a means of optimising the allocation of resources it is unlikely to be bettered. Clearly there are policy constraints that may preclude cooperative development or compromises that might reduce the level of cost-avoidance achievableThese are factored in, to a large degree, within the model. . Procurement strategy decisions are complex, and therefore cost avoidance will typically sit within a wider framework of benefits, some of which may be more important. However, these constraints should not mask the significant financial benefits available from demand-side cooperation when this is possible. To that extent, co-development should be pursued as a policy option, not avoided. Noting the likely opportunity cost of failing to cooperate, greater effort and thought should go into ways of avoiding not cooperating rather than ‘improving’ the cooperation that is happening.

Secondly, in order to eliminate ambiguity, it is recommended that the term “Cooperative Cost-Avoidance Factor” (CCAF), or something similar, is adopted by administrations and economists, rather than the abstract and sometimes misleading term ‘efficiency’. The CCAF would represent the percentage of cost of an equivalent national development avoided by going down a cooperative route. This should clarify exactly what is being considered and how much participating nations’ administrations should expect in the way of financial benefit. It can also be used to quantify the opportunity cost of not cooperating on projects.

Thirdly, in order to avoid distortions arising from the perfectionism fallacy and potential lethargy from a simple ‘break even’ model, it is recommended that the model is used as the baseline or par performance for co-development costs. This would give a ‘par’ CCAF equation as:

Fourthly, administrators seeking greater cooperative efficiencies might look for a percentage of cost avoidance above that expected within the above model; for example, where the co-development is contracted with a single, trans-national commercial entity rather than an industrial consortium.

Fifthly, further work should be done to broaden the application of the model to accommodate – in mathematical terms – the impact of unequal partnerships on the expected value of CCAF, especially as this represents the norm in multilateral projects.

Reflections

In closing, it is worth considering why the ‘myth’ of cooperative inefficiency persists. The word myth is used here in the popular sense of an untruth that is widely accepted as true. Why is cooperation somehow seen as a more costly procurement option? A more thoroughgoing analysis would be welcome, meanwhile the following reflections are offered:

Firstly, the early history of cooperation was highly problematic. Jaguar did not represent a good model of cost avoidance (DeVore, 2013, pp.430–432) however, the management of cooperation is now unrecognisable compared to the approach used then. Jaguar is nevertheless still in service with India, while past failures live long in the corporate memory, particularly cooperative ones. Despite improvements in cooperative management since Jaguar, the difficulties with cooperation, experienced by those administrators who have to make them a reality, are substantial. National, institutional, industrial, personal and other barriers can make securing cooperative benefits highly problematic from the perspective of administrations and industries. That said, the argument here is that, for all the uncertainties, compromises and imperfections the 1/N factor dominates over the factor: burden sharing will typically significantly outweigh any internal cooperative inefficiencies. Pain here is accompanied by gain: demand-side cooperation is brutally effective at generating cost-avoidance.

Secondly, it is worth considering the historic policy context of the period under consideration. This was the period of New Public Management which in the 1990s introduced managerialismSee Shepherd (2018). into government administrations, supported by its theoretical equivalent of Public Choice Theory. This, among other things, emphasised the use of markets to deliver optimal outcomes. Given the competitive, nationalistic behaviours identified by Lorell (1980) in supposedly cooperative programmes, it was not unnatural for policy makers and economists to seek answers outside of government, seeking to exploit market benefits through the use of competition and the rationalisation of defence supply chains. Indeed, much of the critique of cooperation in the defence literature assumes that any deviation from a perfect market is inherently damaging. However, this unique focus on supply-side reform becomes distorted when it ignores significantly greater opportunities on the demand-side. There are signs of a rebalancing of this managerial perspective within economics, as the limits of markets and competition become more apparent (see, for example, Mazzucato, 2019, 2021; Taylor, 2016). The pervasive sense of ‘public sector bad, private sector good’ with government action seen as being on the ‘unproductive’ side of the value boundary (Mazzucato, 2019) made it comfortable to maintain the myth of cooperative inefficiency rather than challenge it.

Finally, there are emerging, heterodox economic theories which may start to provide greater explanatory power of uncooperative behaviours. Gambetta has long argued that “... there is a degree of rational cooperation that should but does not exist” (1988, p.213). Behavioural economics (Thaler, 2016) meanwhile, may provide some insights that are useful in the defence field. For instance, endowment theory (Kahneman, Knetsch, & Thaler, 2011) would suggest that cooperation will not be preferred unless it gives between 2 and 2.5 times the return of a national programme. This is because administrators would unconsciously ascribe greater value to those things they possess or control. Cooperation involves a loss or dilution of ownership/control compared to a national programme and may therefore be rejected for reasons that would be missed by a classical cost-benefit analysis. This brings us back to where we began in Botswana. It would appear that Psychology is one of Puso’s ‘practical matters’ that cannot be ignored.

Crédit image : Andrii Yalanskyi/Shutterstock.com