China and European electricity networks: strategy and issues

Energy policy is a historical pillar of European construction. Since the creation of the European Coal and Steel Community (ECSC) in 1951 up to the policy to implement within the European Union (EU) - but also with the adjacent countries - a Union of Energy, energy issues have been central to the common policy. Becoming aware of the reality of climate change in the 1990s, leading to the definition and implementation of the various Energy-Climate packages, the European Union has embarked on the path of an in-depth change in energy issues. One of the priority areas of efforts, given the structure of Europe's energy demand, concerns the continent's electricity networks. Developed on a strictly national basis, electricity transmission and distribution networks are now increasingly interconnected to form a true continental system. This techno-economic opening has been supported for more than two decades by the introduction of legislation at Community level to improve competition between operators by progressive liberalization of the electricity markets and the - expected - end of state and regions monopolies. However, among the real effects of this liberalization, there is an increasing involvement of non-EU actors, sometimes supported by States. In this context, China, through world-class players, both in the energy field and in the financial sector, has for some years been implementing a systematic buy-back policy for transmission system operators and electricity distributors across the continent. Such a situation could lead, at short to mid-term, Chinese state actors to have a form of economic and technological preponderance over a sector that represents both the future of the fight against climate change, as a pole of technical excellence, but also a central link in the continent's energy security value chain. Through this Chinese policy, which can be seen as a continuation of a global policy to create an interlinked “Eurasia”, questions arise as to the consideration of the strategic nature of electricity networks by the States, the European Union and the various collective security organizations such as NATO.

Electricity networks: the key to energy transitions

The massive integration of renewable energies

Energy transitions throughout Europe are the result of several factors, among which the awareness of the acceleration of the effects of climate change, as well as the desire to limit dependence on foreign oil suppliers are the most important. These transitions, which bear different names according to the country, the most well-known being the German Energiewende, have as a common point to rely on the increase, often significant in volume, of renewable energies in the national mix. Two major steps can be identified, with a visible acceleration when switching to the second. The first is in the second half of the 2000s, around 2007-2008 when the fourth IPCC report was released. During the COP13 in Bali it led to the drafting of a roadmap for the COP15 negotiations in Copenhagen in 2009. If Copenhagen COP15 turned out to be a semi-failure in the end, the European Union decided to consider climate change as a major issue since this moment. At the diplomatic level, the EU had since a common negotiating position at the various COPs, but above all the EU Commission decided to implement in 2008, the third Energy-Climate Package. This represents a series of national and Community obligations related to the energy sector. The three objectives for 2020 are: 20% reduction in greenhouse gas emissions on the 1990 basis, 20% renewable energy (REN) in the European energy mix, 20% energy efficiency rate.

The second major change leading to a redefinition of European energy policies came after the Fukushima disaster in 2011. Nuclear energy, which was at that time popular in Europe, was suddenly questioned in several countries, some like Germany opting for an accelerated outing of nuclear powerBefore Fukushima, Germany decided to close all its nuclear facilities by 2022, then anticipated to 2019., others like Italy confirming their choice not to use itBefore announcing the maintain of its moratorium on electronuclear, Italy was in advanced discussion with the French company EDF for a power plant project.. Renewable energies were thus put forward in the first part of the 2010 decade - also corresponding to the preparatory work for the next EU Energy-Climate Package - as a preferential solution for a transition to a low-carbon electric sector. In 2014, the new Energy-Climate Package came into force and set higher targets for 2030: 40% reduction of greenhouse gas emissions, 27% of REN in the community mix, 27% energy efficiency rate. This Energy-Climate Package, whose objectives are binding at EU level, but difficult to allocate at the level of member states, is in fact the first post-Fukushima phase of the 2050 roadmap for a low-carbon Europehttps://ec.europa.eu/energy/en/topics/energy-strategy-and-energy-union/2050-energy-strategy. This includes extremely ambitious targets, such as 80% reduction of greenhouse gas emissions compared to 1990 levels, and a complete overhaul of the electricity sector in each country. The communication made by the Commission to the other bodies of the Union is clear on this point: "with a more decentralized production, smart grids, new users of the network (for example, electric vehicles) and a responsiveness to the demand, it is more necessary than ever to have a more integrated vision of transportation, distribution and storage."COM 2011/885 on the 2050 Energy roadmap.. It is clear in this particular context that the electricity transmission and distribution grids, beyond the choices made with regard to the energy sources themselves, will be the key to this energy transition.

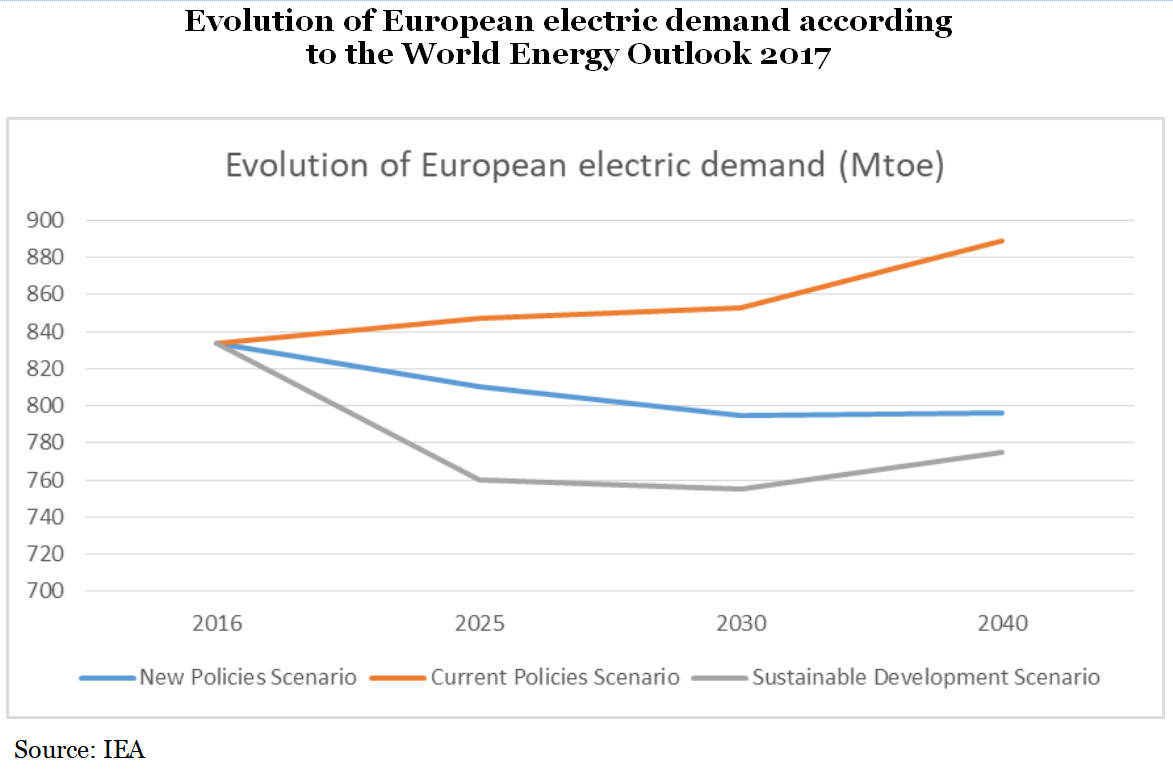

The mass integration of more and more renewable energies could only be thought with actions along the whole ectricity value chain, in particular on the transport and distribution aspects that in countries with mature demand are the main key to regulating production. The various scenarios of the International Energy Agency for the European electricity sector thus provide for a relatively moderate change in demand, between 0.3 and -0.3% per year, according to forecasts.

For Europe, unlike other countries or regions of the world, the main challenge of the electricity sector is based on the improvement of the transmission and distribution system, rather than on the issue of switching energy sources. The sources changes in different European countries are diverse, between geographical constraints and political choices - on the nuclear sector in particular - but the problems of the networks remain at the same time central for all and of community stake.

Smart grids and energy efficiency

From this challenge of improving transport and electricity distribution, both for environmental and economic issuesIn its 2017 report, the French distribution company Enedis estimated the level of losses on the network as 6.3% or 23.3 TWh, almost equivalent to the whole consumption of a country like Slovakia., arises the need to act on the networks. In Europe the electric networks are relatively old, the electrification of the continent having taken place in majority during the first sixty years of the 20th century with difference between countries; as an example France had an important investment plan on networks during the 1985-1995 decade. There is the need to operate an improvement of networks, both continuously by the replacement of out-to-date cables and transformers, but also introducing disruptive technologies, able to solve a significant part of this problem of losses. Two major technology families are considered, both being part of energy efficiency policies: massive storage and smart grids.

On and off-grid storage is a key to integrating REN into the electrical systems of all countries around the world. High-performance battery technologies would thus make it possible to cancel - or at least greatly limit - the problems of intermittency and availability of production inherent to renewable energies. With a large charge-discharge capacity that is always availableIncluding the potential use of stationary electric vehicles as complementary storage points in a vehicle-to-grid policy: http://www.smartgrids-cre.fr/index.php?p=vehicules-electriques-v2g, the storage systems can smooth out the consumption peaks, while avoiding the mechanical follow-up of demand and production curves. For the moment it implies to have auxiliary power stations relying on fossil fuels (coal and gas). However, the introduction of regular charge-discharge storage systems induces a strong resistance of the networks as they would become the regulators of the local or national electrical systemThe change from a production oriented electric system to a demand oriented one constitute an important paradigm change for the whole energy sector, leading to the actual crisis in the utilities business model..

Smart grids are also an important element for the future of electricity. With a myriad of sensors across the entire electricity value chain, from the power plant to the consumer, smart grids can be considered as double networks operating in opposite directions. On the one hand, the electrical network from generation to consumption and, on the other hand, superimposed on it, the communication network, giving in real time to a command and control center the data on the electric network situation. Thanks to this enhanced communication system, the smart grid is able in real time to adapt to fluctuations in the network and to the structure of demand. By anticipating consumption, it offers a flexibility of reaction which, in the long term, would make it possible to identify, even to anticipate, the breaks in electric networks. In this sense, the smart grid, whose first part in France is the Linky meter, would offer, once fully deployed, a drastic reduction in electrical losses on the grid. Given the importance of electricity consumption in France, this would represent an important volume which, in turn, would limit electricity production for an equivalent consumption. In this view smart grids are key devices both in terms of energy security - by limiting imports of fossil fuels - but also in the fight against climate change. The combination of the two technologies, smart grids and electricity storage, part of the energy efficiency family, accounts for most important part of the potential gains in the electricity sector in Europe and, consequently, the most important reduction leverage on greenhouse gas emissions.

In these two subsectors - more specifically in the case of smart grids by their interconnected nature - there is the need of a continental unification. The whole European energy policy, as stated in the Energy Union, aims to harmonize as much as possible the standards and practices through the continent. In this context, smart grids should be normalized. In 2011, the Commission gave a mandate to several European standardization organizations (CEN, CENELEC, ETSI) to come up with proposals on the standards to be adopted. For the time being, these standards are still under discussion, but it is clear that they will be created on the basis of existing technology, especially if one of them is particularly widespread at European level.

Technology excellency

As part of the race to standardize smart grids, some European states have positioned themselves as first entrants, with the aim of imposing a standard based on usage. Germany in particular, through the E-energy program launched in 2008, was the first of the European states to position itself for large-scale standardization by bringing together energy utilities, telecommunications companies and research centers. E-energy, which aimed to develop a smart grid extending beyond the German borders through cooperation with Austria and Switzerland, was clearly meant to become the first multinational real-time communicating network. Other, more limited projects followed between France and Italy or between Spain and Portugal.

From another point of view, the economic competition between General Electric and Siemens for the acquisition of Alstom's energy division in 2014 was also largely due to their desire to acquire technology the smart grid segment as well as to reduce competition in this sector. It is also worth noting, a little more than three years after the merger between Alstom and General Electric, that the American company's promises in terms of employment in France are not kept and that Alstom traditional markets of, with the notable exception of solutions related to the electric transmission, are in sharp declineOther factors can also contribute to the explanation, for example the decline in the demand of electric turbines for conventional and nuclear power plants or the sharp competition in REN..

However, at the European Union level, beyond the technological innovation carried by the energy service companies, most of the costs of R & D and installation of technologies related to smart grids are supported by the distribution companiesC. Cambini, A. Meletiou, E. Bompard et M. Masera, « Market and regulatory factors influencing smart-grid investment in Europe: Evidence from pilot projects and implications for reform », Utilities Policy n°40 (2016), pp. 36-47 ; F. Gangale, J. Vasiljevska, C. Covrig, A. Megolini et G. Fulli, Smart grids projects outlook 2017, Luxembourg, JRC-UE, 2017.. Even if electricity transmitters are also concerned, it is mostly in distribution - whether the national sector appears concentrated or split up, as in Germany or Denmark - that the leverages for economic gain are the most important. The minimum regulation of the electricity distribution market, liberalized since 2003 at the community level, also encourages distributors to embark on a race for innovation and investment that mechanically favors the largest operators.

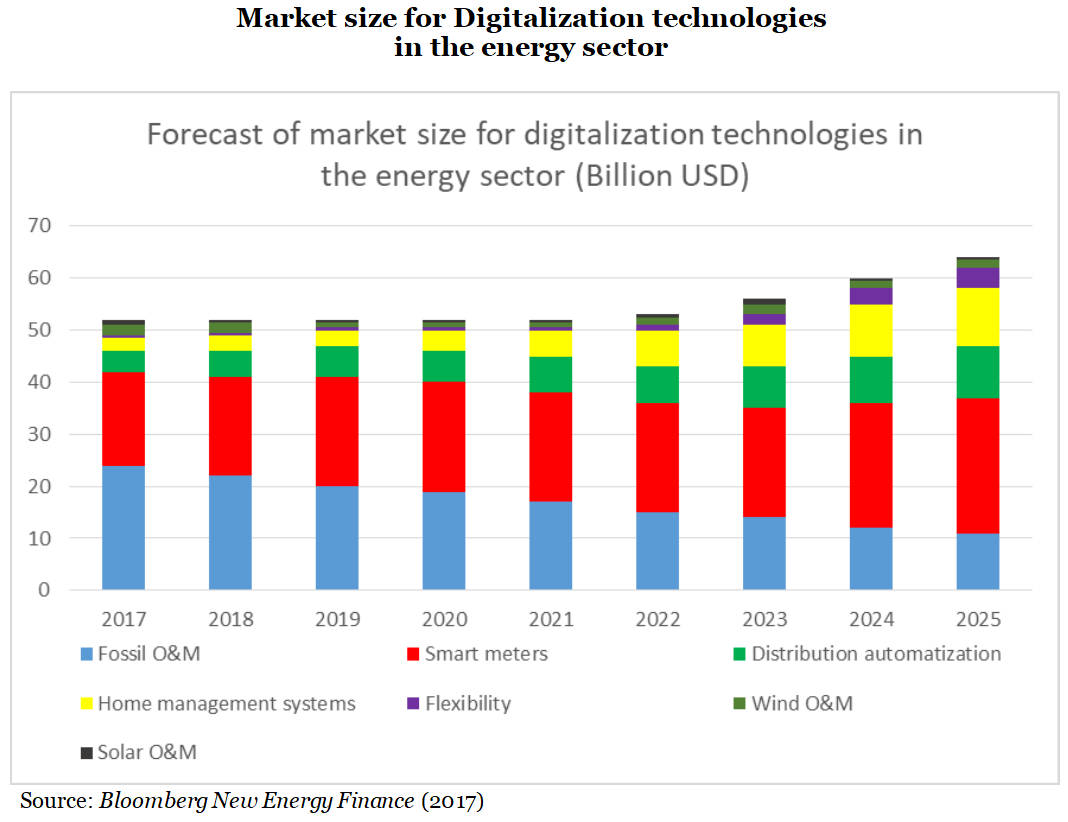

It is also a particularly attractive sector for many companies. Bloomberg New Energy Finance's Digitalization of Energy Systems report, published in November 2017, highlights the growing importance of smart grid technologies, especially meters, in the global electricity market. There is therefore a particular economic interest for electricity companies to position themselves as the leading players on the European continent, which is, for the moment, the main market for this kind of technology.

The global technological race is underway for several years, in Europe and elsewhere. Countries such as the United States (from 2003 with the Grid Wise Alliance and in 2009 through the American Recovery and Reinvestment Act) or South Korea (through the Korea Smart Grid Association) have decided to invest massively this technological field. China, even though it was not one of the first countries to embark on this race, benefited on the one hand from the national concentration of the political decision and, on the other hand, from the technological mobilization capacity through five-year plansD. Xu, M. Wang, C. Wu et K. Chan, Evolution of the smart grid in China, Shanghai, McKinsey, 2010; Y. Li, Z. Lukszo et M. Weijnen, « The impact of inter-regional transmission grid expansion on China’s power sector decarbonization », Applied Energy, 183 (2016), pp. 853-873.. The technological challenge of smart electricity grids and, more generally, energy efficiency technologies, is also a major geo-economic opportunity for companies to position themselves as world leaders in a growing segment and for states to assert their technical and industrial know-how while retaining a certain technological independence.

The consequences of networks liberalization

In Europe, electricity grids went through different stages following changes in community regulations. At first, based on a vertical concentration of activities from production to distribution through transport, they have most often been state monopolies such as in France (EDF) or Italy (Enel). At the end of the 1990s, progress in European policy on liberalizing the whole economy led to the gradual opening of downstream activities to free competition. The European Union is pushing for the deconcentrating of network activities and their separation from production activities. The first important step in this direction was Directive 96/92/EC, which forces Member States to separate the activities of transmission system operator from those of electricity production and distribution. In Italy, in 1999, Enel's transmission and distribution activities were separated and the company Terna was constituted, in Portugal REN, which manages the networks, was separated from the EDP production entity, in France ERDF (nowadays Enedis) was created in 2008 when the directive on the liberalization of distribution operators entered in force; RTE (managing the transmission network) was separated from EDF in 2000.

In 2003, the two Directives 2003/54/EC and 2003/55/EC liberalized the electricity and gas distribution markets throughout the Union, allowing free competition for providers. The 2003/54/EC Directive on electricity markets requires, on the one hand, a legal separation of distribution activities (Article 15) and the third parties access to the distribution network (Art. 20) leading to a de facto liberalization, applicable in 2007. The declared aim of the European Commission was thus to promote free competition allowing the final consumer to have the best possible prices, the Commission considering that monopolistic system, state-controlled or not, prevented this objective to be achieved. However, this situation had unanticipated effects such as concentrations to face the increased competition, like the GDF-Suez mergerStated in 1999 in the French parliamentarian “Bricq Report”, see: J. Condijts et F. Gadhoum, GDF-Suez, le dossier secret de la fusion, Paris, Michalon, 2008.. Some large energy companies also took advantage of this opportunity to expand beyond their borders and thus complete important positions at the continental level, such as Sweden's Vattenfall in Sweden, Germany and the United Kingdom or Spain’s Iberdrola present in Spain and Scotland. The supposed movement of liberalization was thus not complete since it mainly consisted in maintaining the competence on a national basis (France, Italy, Portugal, Spain, Belgium, etc.), but with an economic weakening of transmission and distribution companies. They were deprived of the support of their parent company or their state and were thus often bought back in the middle of the 2000s by the biggest European operators who had been able to anticipate the changes in the regulation.

Nevertheless, transmission system operators as well as distribution system operators - sometimes confused in the same entity or separate - are key players in the electricity value chain. With the evolution of national electricity systems - which itself is causing a crisis in the traditional utilities model - towards an increasingly decentralized production, the managers of both types of networks (transport and distribution) are gaining power. The European Union integrated the issue of the harmonization of the European electricity networks - including the large-scale development of smart grids - within the "A Framework Strategy for a Resilient Energy Union with a Forward-Looking Climate Change Policy ' in 2015https://ec.europa.eu/commission/energy-union-and-climate/state-energy-union_fr. In 2017, the third report on the Energy Union highlights the renewed desire to complete a single energy market in Europe - in particular in electricity - by developing transnational interconnections (France-Italy, for example) in order to achieve both a redundancy in networks and a guarantee of better prices for the final consumer. However, it was without counting on the significant interference of extracontinental state actors from China.

The strategy beyond China buyouts

The Chinese actors

Since the mid-2000s, China, using its state organizations (companies and public funds), has embarked on a massive policy of purchasing strategic economic assets all over the world. The Chinese Investment Tracker of the Heritage Foundation reveals the focus of Chinese actors towards the energy sector. Of the 1,778.41 billion USD invested globally between 2005 and 2017, 663.13 billion were spent in the energy sector, accounting for 37% of the total. This sector, which has been favored for a long time, in view of China's critical fossil fuel supply needs, has seen since the beginning of 2010 a diversification of investments towards the production and transmission & distribution systems of electricity, following the priorities set by Beijing.

The main structure active in asset purchases in the field of transmission and power distribution in Europe is the state-owned State Grid Corp. of China (SGCC). It is considered one of the richest and most powerful companies in the world, ranking second across all countries and sectors in the Fortune Global 500. China's leading electricity grid operator, covering 80 percent of the countryThe rest being held by China Southern Power Grid., is a state-owned enterprise that had a 363 billion USD revenue in 2016, giving it unparalleled economic investment capabilities in the sector of electrical operators. In addition, the company owns the majority of Yingda International Trust's investment fund, providing it with a much greater capacity for action on the markets than other major players in transmission and distribution. Beyond SGCC, other energy players are active in takeovers in Europe and around the world. Other main Chinese energy companies have also concentrated their asset purchases in Europe in the fields of transport and distribution of energy, according to their specialties. The Spanish group ACS for energy and waste services has thus been the target of several Chinese buyouts, first for its recycling subsidiary Urbaser, then for the energy services assets in Brazil, bought by SGCC. Another major Chinese player involved is the state-owned company, Three Gorges Corp., established for the management of the eponymous dam, which has rapidly diversified into asset management abroad - partly through its subsidiary China International Water and Electric Corp. - which led to the purchase of a substantial part of the Portuguese energy company EDP. It is also involved in development prospects in the Balkans, interconnected to the European Union system, notably in Serbia.

The Chinese system, centralized at the level of the central committee of the Chinese Communist Party, has also for many years been based on a large number of sovereign wealth funds and investment structuresB. Kong and K. Gallagher, The Globalization of Chinese Energy Companies: The Role of State Finance, Boston, Boston University Global Economic Governance Initiative, 2016.. Among the most active, the State Administration of Foreign Exchange Investment Fund (SAFE) is the investment arm of the international exchange control agency. SAFE was the first of the Chinese sovereign wealth funds to take part in the purchase of electric assets in Europe with the purchase of 3% of the Italian national electricity company Enel in 2014. However, it is with China Investment Corp., China's largest sovereign fund in terms of capitalization that the largest investments occurred, including the purchase of 11% of the UK's electricity transmission networkUnited Kingdom has been an important investment territory for Chinese energy companies as shown by the Hinkley Point nuclear power plant project..

The Chinese system relies mostly on the National Development and Reform Commission’s supervision. The Commission is orienting the economic development of China, designing its energy policy (through the National Energy Administration) and controlling the public investments outside China. Having a direct control over the State-owned companies’ strategyThe financial management of those companies is made by another body within the Chinese state, the State-owned Assets Supervision and Administration Commission., the Commission could be considered a central platform for national and international economic policy.

Towards a new European map?

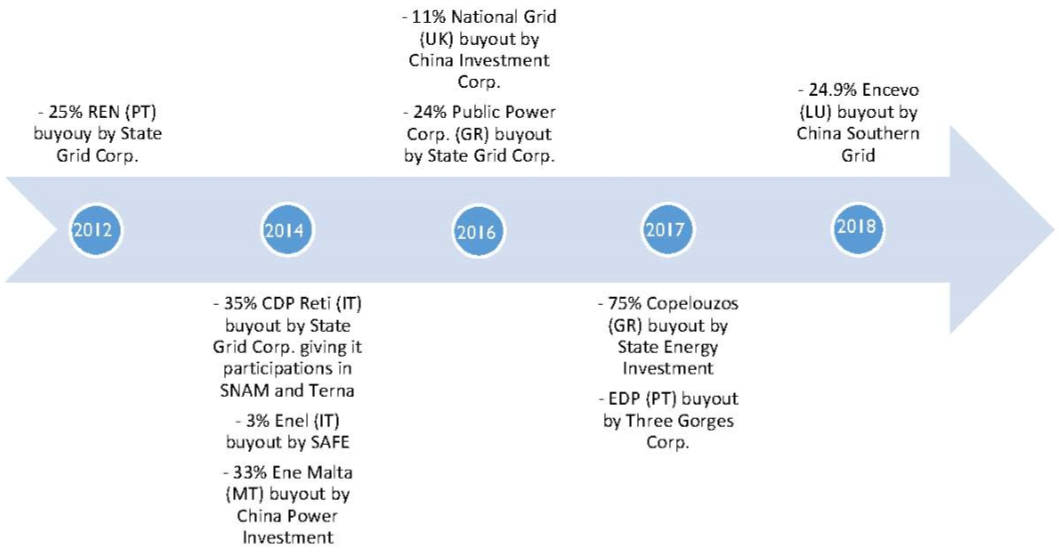

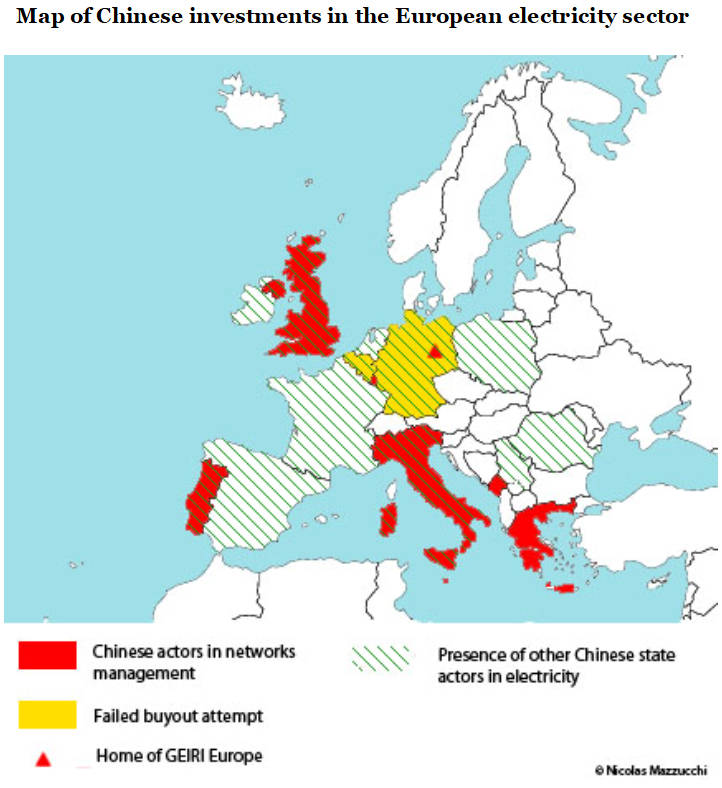

The mapping of Chinese actors’s investments reveals a concentration, for the moment, in Southern Europe countries. Taking advantage of the deep economic crisis in Greece, Portugal and Italy since the early 2010s, Chinese companies and funds benefited from the needs in cash of those states to buy large shares in the national transmission and distribution sectors. The first targeted country was Portugal, which for many years has struggled with the organization of its energy sector. State Grid's acquisition of REN, the national electricity transmission company, preceded that of EDP, the national electricity producerAlso present in Belgium, France, Romania, Spain, Brazil and Mexico., which was later bought by China Three Gorges Corp. Thanks to REN, State Grid became a de facto member of the European Transport Network organization (ENTSO-E).

In 2014, the next SGCC move was in Italy, where it partnered with the Italian state in buying 35% of the CDP Reti fund from the Italian Cassa dei Depositi. Thanks to this important participation, SGCC obtained a blocking minority over the activities of SNAM (gas network operator) and Terna (electricity transmission network operator). Terna is also present in other countries like Montenegro where it owns 100% of Terna Crna Gora. SGCC also continued its development in the Greek networks by acquiring 24% of Public Power Corp. (ADMIE) to the Greek state in 2016 and the purchase of 75% of the private group Copelouzos, becoming de facto the key player in transport and distribution in GreeceP. Tonchev and P. Davarinou, Chinese Investment in Greece and the Big Picture of Sino-Greek Relations, Institute of International Economic Relations, Athènes, 2017..

Targeting Portugal, Italy and Greece - buyouts were made in Spain but in other energy subsectors - Chinese companies and funds have positioned themselves in the struggling economies of the European Union. By offering large amounts of money for assets most often under State control (REN, CDP Reti, Public Power Corp.), Chinese players gained significant influence at the level of each state. In addition, it gave China several canals of information dissemination and influence over the electricity policy at European level, in particular with the ENTSO-E, of which REN, Terna, National Grid and Public Power are members. In a broader security-based assessment, China is therefore acquiring an extensive knowledge of the whole European electric network, including its potential vulnerabilities.

At the level of electricity distributors, the Chinese players, led by SGCC, by taking shares in several important players in the field, could want to propose a convergence of standards and practices - at the multi-national level - on those from ChinaBeyond State actors, Chinese private investment companies, such as CK Infrastructure Holding, are also present in the European electricity sector, possessing distribution networks in the UK (UK Power Networks Holding Ltd, Seabank Power Ltd) or smart meter companies in Germany (Ista).. In July 2018, China Southern grid also entered the market of European networks in buying a 24.9% stake in the Luxemburg based company Encevo, the holding possessing Creos (electricity TSO) and Enevos (gas TSO) of Luxemburg.

We must add to this chronology investments attempted by Beijing that did not materialized, like the attempt to buy 14% of the Belgian electricity distributor Eandis in 2016, which the city of Antwerp finally blocked the transactionJ. Seaman, M. Huotari and M. Otero-Iglesias (dir.), Chinese Investment in Europe, A Country-Level Approach, Paris, European Think-tank Network on China, 2017., or the missed tentative to buy the Spanish network company REE in 2012. Similarly, the purchase offer of State Grid Corp. for a 20% stake in the German 50 Hz company which is one of the four main electricity transmission companies in Germany, has been blocked by the German government in July 2018. In this sense, there is a clear global strategy for taking major shareholdings in the management structures of European electricity gridsSGCC and other Chinese actors are also present out-of-Europe in Australia, Brazil and the Philippines but with a less coordinated strategy (except, maybe, in Brazil)..

The dream of a Eurasian connection

Beyond the issue of the presence of one or more organizations directly linked to the Chinese state within the electricity transmission and distribution sector in various European countries, a global geopolitical vision underpins Beijing strategy. Various publications and presentations, notably from State Grid, show the will to create a global interconnection of electric transport networks from China to Europe. The deployment of ultra-high voltage (UHV) lines in China, which is compulsory to cover such a large territory, could also be applied for the constitution of a terrestrial "electric bridge" between Europe and Asia. This is in any case the dream of State Grid, put forward especially at the August 2012 conference of the International Council of Large Electric Grids (CIGRE): connecting the power generation zones of Western China and Central Asia to the European electricity consumption market by an ultra-high voltage system (1,100 kV) of several thousand kilometersPresentation made by Liu Z., State Grid Corp of China CEO, on 26th August 2012 at the CIGRE, Intercontinental Transmission Highway for Optimization of Global Energy Resources. The same vision could be find in SGCC official documents such as the Corporate Sustainabilty Report 2016..

It could be seen as a continuation of the terrestrial part of the project BRI (Belt and Road Initiative), formerly known as OBOR (One Belt, One Road), of "new silk roads"P. Le Corre, « Chinese Investments in European Countries: Experiences and Lessons for the “Belt and Road” Initiative » in M. Mayer (dir.), Rethinking the Silk Road, New York, Palgrave MacMillan, 2018, pp. 161-175., by a connection of large scale, lashing a little more Europe to China. With the will to relocate, at least partially, electricity production from the European continent to Western China, Beijing intends to create an electrical dependence that no longer relies on supplies of raw materials, but on electricity itself, conceived in this way as some kind of non-substitutable commodity. However this strategy isn’t limited to the European continent as China whishes to implement a global electric interconnection. Chinese state actors established an international association, the Global Energy Interconnection Development and Cooperation Organization (GEIDCO)http://www.geidco.org/html/qqnyhlwen/col20170 80814/column_2017080814_1.html to promote this view. The GEIDCO has partnerships with regional or international organizations such as the Arab League, the African Union or the United Nations

China has long since looked to the European Union for technological co-operation in the field of energy, including so-called "green" technologies to which energy efficiency is linked. The different EU-China partnerships that have succeeded each other since the end of the 2000s, notably the Europe-China Clean Energy Center, active from 2010 to 2015, worked for a technological convergence. The EU-China 2020 Strategic Agenda for Cooperation, led by the European External Action Servicehttp://eeas.europa.eu/archives/docs/china/docs/eu-china_2020_strategic_agenda_en.pdf, also focuses on technologies related to energy efficiency, but also on information and communication technologies, another fundamental brick for smart grids. In 2016, the signature of an EU-China Energy Roadmap reinforces this orientation, with cooperation on energy efficiency devices and electrical networks at the center of the frameworkhttps://ec.europa.eu/energy/sites/ener/files/docu ments/FINAL_EU_CHINA_ENERGY_ROAD MAP_EN.pdf.

At the research centers level, Chinese players have also been able to penetrate the European system with the creation in 2014 of the Global Energy Interconnection Research Institute Europe (GEIRI)http://www.geiri-eu.com/ belonging to SGCC. This institute, located in Berlin, acts as a development agency for academic and technological cooperation on the continent for the Chinese state actor. Three of GEIRI Europe's four research groups are demonstrating SGCC's priorities in Europe (cyber-physical systems security, energy storage, ultra-high voltage power lines). By acting at the scientific level, through involvement in European research networks (e.g. European Technology and Innovation Platform on Renewable Heating and Cooling), GEIRI Europe acts on the upstream part for the future European standards.

Critical technologies in the balance

The 13th plan for Science and Technology presented by the Chinese administration in 2015 makes no secret of the critical place given to energy technologies. The sector is considered, inside the Plan, as one of the 7 key sectors of technological development for the country. Since this plan, it is important to note the efforts that have been made by Chinese companies and state organizations to implement the deployment of new technological solutions, particularly in view of a national energy transition. China is one of the first countries to adopt a generalized system of smart meters in 2017, again the first stage in the development of a national smart grid.

It is also important to note that China is attempting to achieve a dominant position in the electricity storage market, first at the vehicle level, and then in high capacity storage on and off the grid. The economic alliances within the energy sector in China on this particular issue, show on the one hand the willingness of the electricity players, starting with State Grid, to position themselves in this sector and, on the other hand, the gradual shift of battery producers towards a greater level of production and technologyThe national batteries producer CALB, itself subsidiary of the aviation company AVIC, has partnerships with electricity sector companies such as State Grid and China Southern Power Grid; see N. Mazzucchi, Transition énergétique et numérique : la course mondiale au lithium, Paris, FRS Recherches et documents n° 05/2018, 2018.. The proliferation of patent filings in this field is also a sign of China's global orientation towards the domination of the market for electric storage technologies - in particular lithium batteries - to solve, at least partially, the energy equation of the country.

In addition to storage-related technologies, Chinese energy companies have also been extremely active on the issue of smart grids through the know-how of telecommunication companies and those related to power grid management. The presence of Chinese state organizations in the telecommunications sector in Europe, as well as China's willingness to become a normative player in this field, are not new, and it is highly likely that the convergence between the electricity grids and the information and communication technologies needed for smart grids is facilitated. Chinese state capitalism, while allowing firms some leeway, is nevertheless highly prescriptive on technologies considered as key, under which smart power grids appear clearly in strategic Chinese documents.

Finally, electricity transmission and distribution networks are key elements of a state's security and defense. They constitute a vital infrastructure for the economy well as for the communications of a country. Several documented cases show that power grids tend to become primary targets for cyber-attacks, which tend to increase with an increasing connectivity. In this context, particular attention should be paid to securing these networks at European level. An evolution of the European Information Systems Security Agency (ENISA) towards a cybersecurity product certification agency should, if this were the case, be carried out according to particularly high standards. Top-down harmonization of EU Member State regulations is absolutely necessary, under the control of the public power, to ensure an optimal level of security for a sector that will naturally become a target of choice for cyber-aggressors, state-sponsored or not.

Stakes and recommandations

Several issues emerge from this vision. The first is of a geopolitical nature, the buyouts of multiple transport and distributions operators, on a large scale, constitute a continental energy security issue, especially with the growing interconnection at a transboundary level. Several major transporters and distributors are now partly or wholly dependent of an extra-European state through various economic or financial mechanisms. This situation naturally rises concerns about China's actual or supposed intentions vis-à-vis the European electricity sector, which, split between various companies, represents an easy economic prey. Beijing's willingness to move towards electrical integration at the Eurasian level lead to the risks of both a sharing of energy security issues between Europa and China and an a priori orientation of EU Member States energy policies to China. By positioning themselves at the end of the energy value chain, Chinese state-owned enterprises thus have an important leverage, particularly in view of the entire European energy sector evolution.

The second observation is techno-regulatory. The acquiring of the technological know-how of European companies on the issue of smart grids is coupled with the possibility of regulatory pressure from State Grid towards standardization according to its own standards. By completing a form of continental dominance over next-generation power grids, SGCC could launch a normative offensive at the community level relying on its European subsidiaries.

From these observations, several recommendations emerge. First the need to reconsider the policy of liberalization of the networks carried out through 2003/54/EC Directive in terms of energy security. In view of the potential implications, the challenge of Europe's technological and geopolitical independence should be a priority. In a sense the policy pursued for many years is a response to the very essence of the economic opening up of the European market, but it ends up weakening both the cohesion and the security of the Union. In certain countries, like France and Spain, public authorities still possess the majority stakes in transportation networks, helping to preserve their independence. This situation permitted Spain to prevent in 2012 SGCC from buying the network company REE, even with very generous offers from SGCC.

Secondly, this situation of a deep fragmentation of the transport and distribution sectors, if it is consubstantial with a desired and decisive liberalization policy in Brussels, does not exclude concertation at Community level. ENTSO-E, which brings together transmission system operators at the European level, does not have the same regulatory and standardization capacity as the North American FERC-NERC pair. On the contrary, ENTSO-E - just like ENTSO-G in gas - appears rather as a facilitator of interconnection and a forum of discussion between the different actors. The transformation of this organization - which could also include distributors - into a true European regulator at the same level of the FERC, especially in the role of the latter in controlling the acquisitions of assets in electric field, could compensate for the preponderance of an economic actor. The liberal logic implemented so far, if it is not to be called into question, must be accompanied by a real control of the operators at Community level to ensure that they work above all in the direction of European interests, including in terms of energy security. According to the Derdevet report of 2015M. Derdevet, Energie, L’Europe en réseaux, Paris, La Documentation française, 2015., cooperation between transportation system operators on the one hand and distribution system operators on the other should be encouraged at a European level, to strengthen their resilience. This policy appears fundamental with the perspective of smart grid development and implementation.

Finally, a third development is possible with regard to the safeguarding of European electricity infrastructure operators: the creation of a system of golden shares in companies at the state or community level. As Brazil set up in 1997 within Petrobras during the liberalization of the oil sector, this would mean allowing the public authorities to have a capacity to block decisions that would go to against the public interest. Even if the golden shares system is judged by the Court of Justice of the EU (CJEU) as contrary to the liberal rules of the Union, various companies benefit from it; for example, Volkswagen of which 20% of the capital is owned by the land of Lower Saxony through this policy. As in the case of Volkswagen, it would not be a question of prohibiting the mobility of the capital but of preserving a capacity to act on the strategic decisions of the company. Such a solution should be justified here because of the nature of the electricity transmission operators that are a natural monopoly, in essence, which prevents excessive competition. In the same way, a unification, partial or global, of the possession of electricity distributors of the continent, under the direction of a single extra-European State, would profoundly be opposed to the political and economic philosophy of the Union. There is therefore an urgent need to put in place a European safeguard mechanism to avoid it.

China and European electricity networks: strategy and issues

Note de la FRS n°17/2018

Nicolas Mazzucchi,

September 11, 2018