Fact sheet No.8: Economic cooperation and business Promoting trade and exchanges with the Indo-Pacific

La France en Indo-Pacifique n°08/2023

Antoine Bondaz,

Marie Desbonnets,

December 18, 2023

The Indo-Pacific is a major hub of the international economy, accounting for 36 percent of global GDP in 2022, and hosting three of the five largest economies (China, Japan and India). While it serves as an engine for growth, disparities are significant. China’s economy accounts for half of the region’s GDP, and there are extreme differences in terms of development levels, ranging from Singapore on one end ($90,000 per capita/year), and Somalia and Madagascar on the other ($500 per capita/year).

The region is at the heart of international trade, particularly maritime trade that passes through key straits such as Malacca, Taiwan, Hormuz and Bab-el-Mandeb. Eight of the world’s top 20 exporters are in the Indo-Pacific (China, Japan, India, South Korea, Singapore, Taiwan, Vietnam and Australia). Over 40 percent of EU trade passes through the South China Sea alone, and any crisis in the region would have considerable negative consequences for the French economy.

With the region accounting for 16.8 percent of France’s foreign trade in 2022, and 35.4 percent if only non-EU trade is considered, many public and private players are working to facilitate trade, such as the 24 Business France offices. In November 2022, President Emmanuel Macron became the first European head of state to be invited to the APEC summit (see Fact sheet No.3 – Diplomatic network and official visits).

UNBALANCED TRADE ON THE RISE

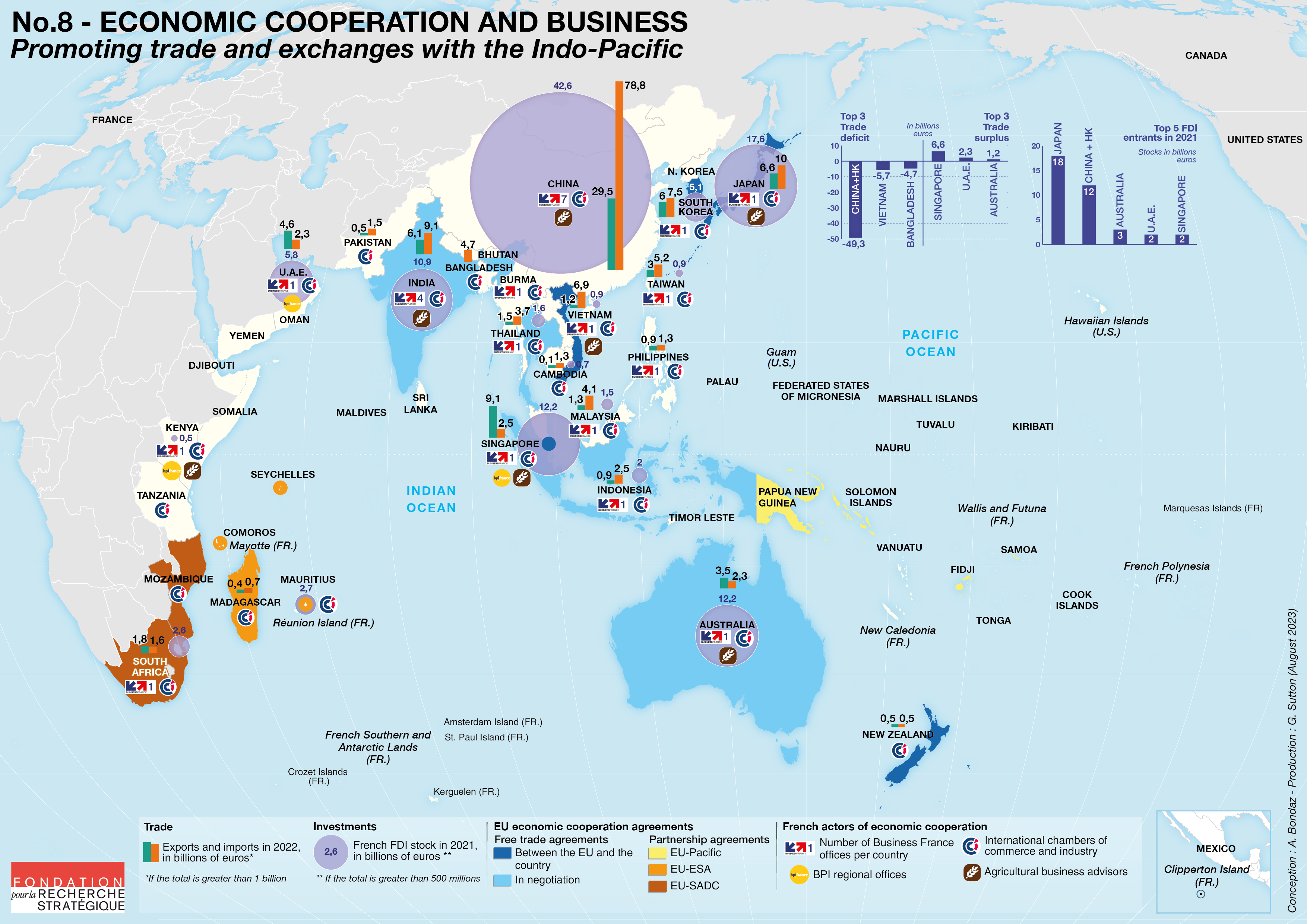

According to French customs, with around 80 billion in exports (13.6 percent, and 30.7 percent outside the EU) but 150 billion in imports (19.3 percent, and 38.6 percent outside the EU), the trade deficit with the Indo-Pacific is substantial – almost 37 percent of the total deficit. Over ten years, trade with the Indo-Pacific region has grown faster (+58 percent) than with the rest of the world (+40 percent), but in an unbalanced way. As a result, the trade deficit with the region has risen by 240 percent in ten years, while it has increased by only 86 percent with the rest of the world.

Trade with China is essential as it represents almost half of France’s trade with Indo-Pacific countries. China is the only country in the region to rank among France’s top 10 trading partners, with a volume of trade approaching that of the United States. China is the 2nd largest source of imports (78.8 billion euros) and the 7th largest source of exports (29.5 billion). Above all, China represents France’s biggest trade deficit (49 billion euros in 2022).

Trade with other countries remains limited, with varying dynamics over ten years. Japan is the 2nd largest trading partner in the Indo-Pacific region, but trade has remained stagnant. India has become the 3rd largest trading partner, with trade doubling, but only on a similar scale as trade with the Czech Republic. The most significant increases were with Bangladesh (+213 percent) and Vietnam (+145 percent). However, trade stagnated with Indonesia, Malaysia, Singapore (France’s leading trade surplus partner with 7 billion euros) and South Africa. Trade with Australia is limited, comparable to that with Greece.

As concerns the European level, the signing of Economic Partnership Agreements (EPAs) and Free Trade Agreements (FTAs) has encouraged trade. These include FTAs with Singapore, South Korea, Japan and Vietnam; the EU-Pacific EPA with Fiji, Papua New Guinea, Samoa and the Solomon Islands; and the EU-East and Southern Africa EPA with the Comoros, Madagascar, Mauritius and the Seychelles. An FTA has been concluded with New Zealand, and others are under negotiation with Australia, India, Indonesia and Thailand.

KEY ACTORS SUPPORTING TRADE

Business France, with its 24 offices in the Indo-Pacific region, is the national agency for the internationalisation of the French economy. It is part of the Team France Export platform, which consolidates solutions provided to help French companies. Customs have a network of three customs attachés based in Beijing, Dubai and Bangkok, covering 13 countries (see Fact sheet No.5 – Security and police cooperation). There is a network of ten agricultural affairs advisors covering 32 countries. They support and promote the interests of French companies in the export sector.

The public investment bank, Bpifrance, contributes to providing financing solutions, with regional offices in Kenya, the United Arab Emirates and Singapore. In 2021, Bpifrance signed an agreement with Proparco, an AFD Group subsidiary dedicated to the private sector (see Fact sheet No.6 – Development aid and the environment) with 6 offices, to finance key sectors such as energy and pharmaceuticals.

The Fonds d’études et d’aide au secteur privé (FASEP) is a grant scheme run by the French Ministry of the Economy and Finance to finance feasibility studies and promote the expertise of French companies, particularly SMEs. The RIVER project, co-financed by Michelin, aims to train 6,000 small rubber planters in Sri Lanka via a platform developed by the French company KSAPA. In 2021, a funding program on innovative solutions for decarbonisation helped 5 projects in the Indo-Pacific (Cambodia, India, Maldives, Tanzania and Vanuatu).

Foreign trade advisors, appointed by the Prime Minister for a three-year term, form a network of business leaders and international experts who play a role in promoting and supporting the internationalization of companies. Of the 1,627 advisors assigned abroad between 2021 and 2023, 472 were appointed in 28 Indo-Pacific countries, i.e. 30 percent of the total. These include 100 in China, 30 in Singapore, 4 in Oman and 1 in New Zealand.

LIMITED INVESTMENTS

Companies have stepped up their investments in the Indo-Pacific. According to the Banque de France, there was a stock of over 120 billion euros of French FDI in the region in 2021. These investments have increased sixfold in 20 years, and represent 9.5 percent of the world total, compared with 4.2 percent in 2001. These investments are highly concentrated in China (43 billion), Japan (18 billion), Singapore, Australia and India (around 10 billion each).

The region’s companies are investing in France, but these investments only represented a stock of 40 billion euros in 2021. Although they have increased tenfold in 20 years, they only account for 5.4 percent of total foreign investment. They created or maintained 3,807 jobs in 2022, i.e. 6.5 percent of the total, as much as Italian FDI and six times less than American FDI. Japan leads the way with 1,158 jobs, ahead of China (1076) and Vietnam (427).

Since 2018, the Choose France summits, extended to Choose La Réunion in 2019 (see Fact sheet No.1 – Overseas territories), have been used to demonstrate France's economic commitment to the region. In 2023, the Taiwanese battery company ProLogium made public its plans for a plant in the North of France worth more than 5 billion euros, and Korean food processing company Sias its plans for a plant in the Lower Rhine region.

WELL-ESTABLISHED BUSINESSES

French companies have a significant presence in the Indo-Pacific region, boasting over 7,000 subsidiaries. They also recruit international business volunteers (VIE). As of July 14, 2023, of the 2,600 offers, 11.5 percent were for 24 countries in the region, mainly in China, the United Arab Emirates and Australia. There are also French chambers of commerce and industry (CCI) in 24 countries. And, in a sign of growing interest, the MEDEF co-organized, with the Ministry of Europe and Foreign Affairs, the first Economic Meetings on the Indo-Pacific in 2022.

Some groups have a long-standing presence in the region, such as Air Liquide, which has been present in Japan since 1907 and in Singapore since 1917. The company has offices in 19 countries in the region. The Aéroports de Paris Group (ADP) manages 6 of its 27 airports in the Indo-Pacific, India, the Philippines and Madagascar. Its subsidiary ADP Ingénierie helped design the airports of Dhaka in Bangladesh, Beijing-Daxing in China, Jakarta in Indonesia and Dar es Salaam in Tanzania.

Last but not least, French Tech’s international communities help to raise the profile of the start-up ecosystem by bringing together innovation players and mobilizing them for joint initiatives (see Fact sheet No.11 – Scientific cooperation and innovation). By 2023, there were 21 communities in 19 Indo-Pacific countries, including two new ones in Indonesia and New Zealand. In the overseas territories, the recently created French Tech La Réunion complements those in French Polynesia and New Caledonia, the latter of which is celebrating its 10th anniversary.

Fact sheet No.8: Economic cooperation and business Promoting trade and exchanges with the Indo-Pacific

La France en Indo-Pacifique n°08/2023

Antoine Bondaz,

Marie Desbonnets,

December 18, 2023